There is a revolution going on in the mobility provider space. You’ve heard it all over the place, it’s on TV, it’s constantly in your face …. it’s 5G. It’s promised to be magical. When you hear or think about it you generally assume it’s all about the opportunity to purchase a new mobile device or perhaps new base-stations and radios on poles being deployed. That’s because it’s often advertised as only being about consumer devices and better mobile phone speeds. You see the pictures and clips in advertisements of happy, smiling people interacting with their mobile devices and their minds are blown! You dream of being one of those happy people and you envy them. Thankfully, there is in fact more to all this. It can change your work life. There are very interesting and useful business features that come with it that will affect your everyday work experience and how business functions. 5G may actually make your work life as digitally productive as your life-life, which has been a long time coming. PacketFabric is at the forefront of that part of the revolution and perhaps in ways you may not have considered.

That may sound like a wild claim for an “agile cloud core” company to make. We don’t own towers or radios and we didn’t buy any spectrum. We don’t sell handsets, build a mobile app or sell an OTT service. We didn’t have to. PacketFabric is part of a revolution in network architecture that accelerates Enterprise cloud connectivity and consumption; 5G is another way to access the internet along for that ride. This is the case whether 5G is a mobile access solution or fixed wireless providing a replacement for fiber, cable, copper access to enterprises.

While 5G brings technical innovations that enable a much broader potential set of applications, these applications and services will be judged much more critically by you as an employee, industry analysts and the Enterprises themselves:

- Are the cloud services used to run the business faster, more interactive, less latency, fewer dropped packets and overall a better experience?

- Do the new apps and services make business run faster, make their business more productive, more collaborative, more secure?

- Is the data in motion to where I need it to be?

- Are the workflows across multiple clouds easy to set up and can the headache and overhead of DIY, self-ownership and management just disappear?

- Is an enterprise “locked” into one cloud service provider or vendor?

As industry analysts’ focus moves from the raw number of “consumers” to “mobile or remote employees” and the performance of the applications and data movement across multiple clouds and cloud service, they have to wonder:

- Will the traditional telco make such a shift to being a multi-cloud enabling provider?

- Can telcos make this shift in a time that’s relevant for national and global economic growth? Can they change technical and business models fast enough for the revolution?

- Is 5G slicing really going to be useful or widely adopted?

- Who is going to provide the Internet exchange functionality deep at the edge to provide access/routing to the cloud services?

- Who is going to make this all work and have it integrated into my business motion?

When it comes to enabling cloud-based architectures, telcos have already missed that turn for the Enterprise. They have no direct role in the cloud effect of the digitization revolution. Traditional telcos and cable companies are just NOT cloud. CSP agility, economics and innovation has quickly dominated this space.

Thankfully there’s an alternative answer available now versus waiting a decade for the traditional telecom companies to deliver what’s necessary.

For the Enterprise cloud journey, Network-as-a-Service providers (NaaS) like PacketFabric have built our business to deliver what’s necessary to get your enterprise to cloud and to fully digitize your IT stack. We’ve focused solely on a Network-as-a-Service and a cloud core.. We’ve focused our target on real time, on-demand, guaranteed networking services that can be “sliced” and measured for exactly how any enterprise will want to use and access all of their multiple cloud services to run their business.

Enterprise 5G Is About Cloud Applications and that’s the Problem for traditional Telcos

The traditional telco providers started THEIR 5G journey in a really deep investment quandary. You can read about the staggering tens of billions paid out for spectrum in any trade publication or on the FCC website. We all know consumers aren’t going to pay a big premium for 5G (the ARPU is stubbornly inelastic there). While the ROI is there (eventually) for 5G consumer services, telcos have hoped to be relevant in Enterprise use cases to really profit.

P-LTE (4G and 5G) for industry verticals and the massive scale and the spread of IOT are the critical, targeted telco use case revenue streams for investment recovery and income generation from the 5G spectrum in Enterprise environments – ostensibly because there is some reliance on telco for these applications.

IoT is projected to grow from a $200-$400B market in 2020 to become a $1T+ global revenue opportunity by 2025. These estimates come from a range of sources, but even the most conservative is eye-popping. Smart cars and telematics are included here.

5G/P-LTE is expected to increase telco revenue from its present $4B (global) to $7.5B to $10B by 20251 – a smaller, but still significant business.

However, even that assumption may be false.

The problem for telco is that enterprises; M&E, sports, healthcare – every single business vertical – is rearchitecting their IT stack. Almost everything for business today is in the cloud and consumed aaS and their trajectory is toward complete ITaaS or Productivity-as-a-Service. PacketFabric is the company bringing the last part of the IT infrastructure stack to a cloud model. It’s the philosophy of NaaS.

At the top of the “cares about” list at every Enterprise is Digital Transformation and that means cloud based services and apps.

A recent Flexera survey showed 99% using at least one cloud service (97% having at least one public cloud and 80% having at least one private cloud) 87% were hybrid cloud users with an average of 2.6 public clouds and 2.7 private clouds. THAT is a lot of clouds!

The problem is that telco didn’t build connectivity to all the DCOs, all the cloud regions, all the SaaS, Storage, UC and Security clouds and didn’t create an automation stack for “easy button” access or a cloud consumption model for their network. Their consumption model is still to place an order with a massive commitment, roll a truck, wait weeks and then “hello? hello?” – bottom line, the cloud is not a telephone or set top box. The technical and business model is broken.

Unlike traditional consumer applications, a very low percentage of the value proposition for Enterprise applications is ascribed to wireless connectivity (for IoT, it’s only ~8%). The lion’s share is in the back end – the applications themselves. Analysts have long pointed to a lack of value-add (above and beyond data transport) Operational Technology (OT) expertise within traditional telcos to make them suitable operational partners for these new markets – particularly IoT, Industrial and smart city, healthcare, factory, distribution, etc .

All that value is left to cloud based businesses who can move much faster and have expertise in building with the service catalogues of the hyperscale clouds. In fact, the data from things is being analyzed, stored, processed, etc in multiple clouds. Thus, the move to multi-cloud and the reliance on data-exchanges.

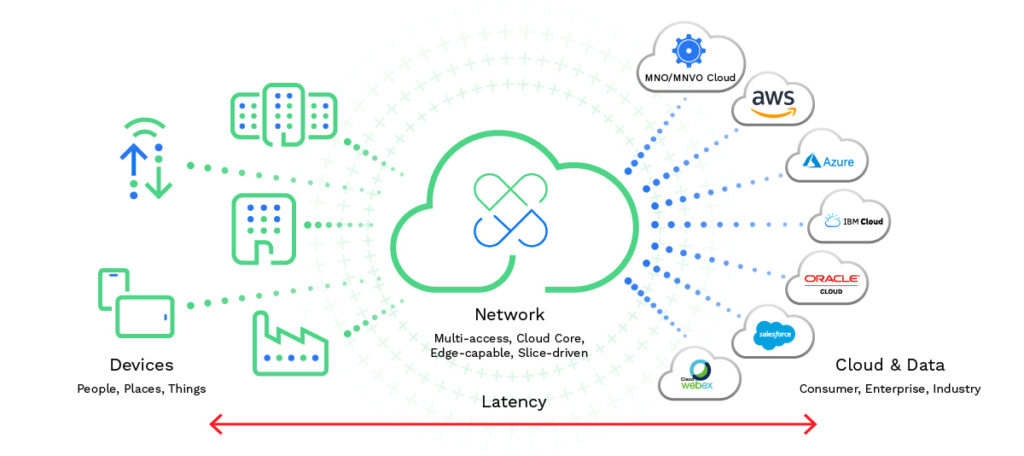

The PacketFabric network was built to serve multi-cloud data flows. We provide operational efficiency and business agility for that “middle mile” transport of access-to-cloud or cloud-to-cloud solutions.

An explosion of new higher-level partners, often with no mobility network experience per se but with extensive industry specific expertise, is anticipated to provide managed services to fill that “value added service” gap. There are at current count at least 30 “disruptor” companies in the IoT space, with a range of segments they cover from the vertical specific focus of a Cubic in automotive/smart car to the much broader scope of a company like 1NCE (SIMs for variety of applications including vehicle telematics, tank monitoring, asset management, smart meters).

Similar disruptions can be expected for both the lighter Enterprise IT and heavier industrial OT integrations for the 5G/P-LTE opportunity. Of the more than 100 announced P-LTE deployments by late 2020, only 16% were “provider led” managed services. Third parties like network equipment vendors, challenger vendors (Mavenir, Athonet), vertical specialists acting as integrators (Airspan/Foxconn Fii) and even the Enterprises themselves (with the help of off-premises SaaS augmentation) are all alternative primary operators to the traditional telco.

In short, the gaps in telco network architecture and operations alignment with cloud and their lack of qualification as OT specialists, solution delivery experts or integrators has significantly reduced what (on paper) seems like a sizable 5G Enterprise revenue opportunity for the traditional telco and opened it to disruption. One exception is connected cars where they have partnered with the major automobile manufacturers.

5G Operation IS A Cloud Application and how the Internet Architecture is Evolving

Many of these new 5G partners (particularly for Industrial IoT applications) will position themselves as “infrastructure light” participants (MVNOs), focusing almost exclusively on the OT and back-end cloud services where they have expertise or (in the case of 5G/P-LTE) local access operation and OT integration.

In response to this shift, a new wave of Mobile Virtual Network Enablement (MVNE) has sprung up in the cloud, leveraging the SaaS consumption model to change the nature of the MNO/MVNO into a cloud application. PacketFabric specializes in creating just such an on-demand, fault-tolerant cloud core that’s necessary to build the new business vertical.

Next, even the mobile subscriber/device access management is going to the cloud. This means that telcos have to reinvent how they fundamentally deliver the service. Beyond the numerous vendors of eSIM onboarding and management tools, the virtualization of access connectivity elements like the packet core (subscriber session termination apparatus) are also part of every public cloud application portfolio. The use of these virtualized elements is assumed to be the most operationally efficient technology strategy for partners going forward. Operation and management of these core components can be consumed as a SaaS – MVNO toolkits or Cloud Managed Radio services (even when the equipment is on-prem, as will be the most likely case for P-LTE).

For example, companies (ISVs) like Emnify have stepped in to offer a Packet Core SaaS (in AWS) on which partners can layer CRM and BSS specialties, HSS, IMS and SBC services – all adjacent applications in the same large public clouds. Microsoft’s Azure for Operators (including acquired assets Affirmed and Metaswitch) looks like a similar but integrated (with IaaS infrastructure) cloud mobility platform.

New MNO’s are entering the 5G marketplace without the traditional infrastructure focus and architecture pre-disposition of the traditional big public telcos. They too are going to follow the cloud-first models of the new-breed MVNOs: from cable and utility companies to industrial automation giants. The latter are focused specifically on the Enterprise opportunity and controlling the business model. Since they have to develop a radio/device controller, they may want to avoid the overhead of having to integrate around the vagaries of potentially hundreds of traditional MNOs spectrum and radio compatibility problems to craft working solutions for global product use.

In this new model, everything that IS NOT the radio is being provided by someone that isn’t a telco and can be consumed as a cloud service. ORAN, new chipsets and the incursion of large cloud providers beyond the metro edge may even change that for the radio. It’s a tough business world out there for the incumbents.

The cloud has become key to unlocking the value chains for the Enterprise applications enabled by 5G spectrum and technology. PacketFabric has built the cloud core and middle mile as a NaaS. Unless the telcos invest in companies with OT experience (which is happening in some niche cases) and without a true NaaS, telcos may be moving inexorably toward becoming de facto SpectrumCos or generally, AccessCos.

PacketFabric enables the OTT wholesale clients of SpectrumCo(s) (new breed MNOs and MVNOs) to dynamically grow their market presence, expand service, and link wireless access networks to cloud with fully automated network operation (cloud-based API operation), flexible consumption and billing.

Slicing And Transport To Cloud, or “Why the Same Old Internet Core Won’t Do”

The good news is that other 5G innovations (slicing and APIs) will help with the “wholesale-connectivity-to-cloud-enrichment” architecture that is evolving for Enterprise 5G applications.

5G scalable numerology (supported by the 5G New Radio) in the time frequency grid will allow slicing (resource segregation and optimization) on the radio interface for “front side” efficiency – a better match between spectrum, bandwidth and latency for general service categories (asset allocation); enhanced Mobile BroadBand (eMBB), IoT and Ultra Reliable Low Latency Communication (URLCC). What all those acronyms mean is that an enterprise can buy bandwidth for its employees. Instead of previous radio-controlling algorithms attempting fairness, 5G enables bandwidth priority on the radio and for sale, by the “slice.”

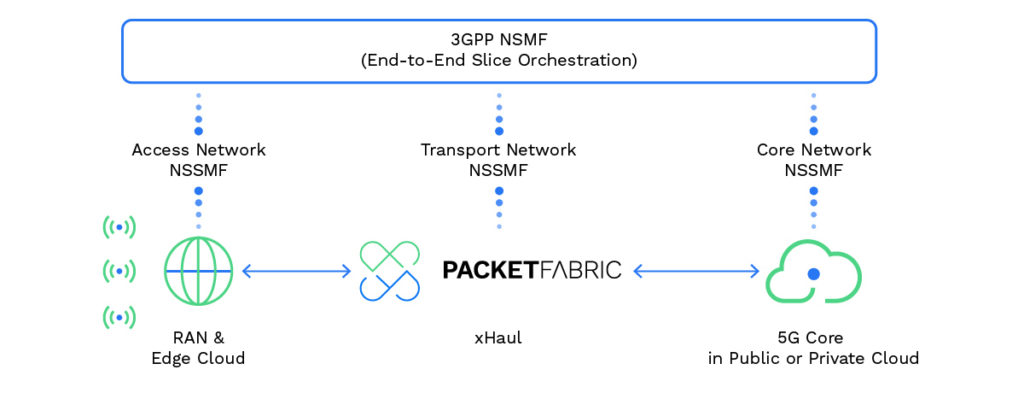

Additionally, that concept can be mapped to separate treatment of slice flows in the xhaul – the network(s) spanning the Radio Access Network (RAN) and the mobile packet core(s). This extension of resource allocation beyond the APN (sub-slicing in the packet core) of “prior Gs” to create true end-to-end service segregation.

In simple terms, an enterprise can buy X Gigs of Bandwidth from the radio and across the core. it can increase and decrease on demand, it can move around the network depending how and where an enterprise wants to use their bandwidth.

All of this capability is envisioned as dynamic (on-demand) and can be truly game-changing enablement for cloud-centric Enterprise 5G wholesale partners.

PacketFabric is ready to support that enablement. Software Defined Networking in transport – NaaS – is key to the delivery of slicing. We are the only x-haul and WAN partner that can deliver real-time, on-demand slices for 5G via virtual circuits across our fully traffic-engineered private backbone. And the telemetry we capture can be to the aggregate, slice and sub-slice levels and as such, provides the accounting and billing environment to recognize the promise of 5G slicing.

The 3GPP has described a slice framework for hierarchical cross-domain network slice orchestration (Slices == Network as a Service) that recognizes not only the new cloud-centric reality of 5G but also the functional NaaS requirement in transport. It makes the transport network a separate NSSMF (Network Slice Subnet Management Functions) with its own API (along with the radio network and service core).

On their existing infrastructure, the operational barriers that traditional telco services erect cause so many headaches that any prospective partnership NEEDS to be based on “API glue” versus their existing “human glue”. The 3GPP NSMF architecture seems to be a nod toward this reality.

For an API-driven on-demand transport network like PacketFabric, it’s a familiar operations model. We have a stable well-tested API that has been providing these services to our customers for almost a decade.

While latency is a highly hyped and often nebulously defined motivation for many 5G use cases, it is really just a generalization around “user experience.” The reality is that the real latency for ANY traffic, whether in a slice or not, is the shortest latency from device to cloud (or multi-cloud). The only role for the traditional telco is the radio, leaving the cloud core to NaaS platforms like PacketFabric. We are that real-time, programmable Internet where you can specify exactly what you want and only pay for what you use.

The “Telco Edge” is Really a Hybrid Cloud Expansion and a Pure Cloud Movement

In spite of the 5G innovations that enable Enterprise applications, it’s hard to see the traditional telcos benefitting from 5G in Enterprise beyond the innovations that have optimized resale of their spectrum assets (wholesaling).

Again, the biggest immediate problem for legacy telco is that their networks were designed for aggregating front/mid haul to centralized Evolved Packet Gateways – NOT to get to the cloud services. What this means is that their networks are built with regional cores of vertically integrated equipment and they haven’t deployed widely distributed DC/Colo space out by the towers and near their customers. While this was essential for lowering the cost of terminating consumer mobile sessions, it necessitated suboptimal network overlays for new Enterprise application “slices” going to cloud destinations.

At PacketFabric, we’re not an overlay; we are a fully engineered next-generation Service Provider. Overlays just hide the fact that you have no control, and that lack of predictability means tons of mitigation to reign it in.

The vision of telco edge cloud (or Multi-Access Edge Cloud/MEC in ETSI parlance) to support RAN element disaggregation and gain a telco foothold in cloud computing has yet to emerge with an economically feasible architecture (for them). They lack edge colocation space (which a huge and separate industry is now providing) and a suitable control plane for agile cloud connectivity, resource placement and scaling.

The TowerCos (formed by these same telcos to free capital from those assets2) have incentives to create revenue streams from “edge computing” at tower adjacent sites that exist or are to be built.

Some have already pursued this strategy with big public cloud providers, bypassing any dream of a “telco cloud” beyond those virtual radio components for their own consumer services which may well end up running on a cloud partner “edge compute” stack. Newly announced alliances between radio providers and the large IaaS players seem to be confirming this reality. The OpenGridAlliance is one example of a group of companies organizing around this opportunity.

Logically, right behind the arrival of the IaaS players in this space will be the “rise of the IX/colo at the tower” and the ultimate reality that the “edge cloud” is going to be wildly different from the original industry pundits.

These inevitable moves will entrench the existing enterprise hybrid-cloud architecture (with transport providers like PacketFabric) and make discrimination between an “Edge Cloud” and “Public Cloud” as envisioned by the 3GPP (with separate orchestration and management systems) completely moot. In this case, the business assumptions of the technical specifications underlying 5G have become a boat anchor.

I say this because if the key measure of 5G success is bandwidth and low latency from the device to the cloud, the new peering and exchange point of cloud providers, DC on-ramp, DIA/transit, is at the tower. The Internet Architecture is fundamentally changing and must change.

As peering moves from regional to metro to tower, and given the TowerCo or some FiberCo joint venture’s incentives, does ANY telco really have an advantage in 5G delivery for Enterprise services? It’s hard to see that the telcos are in a leadership position with their legacy IT stacks and rigid business constructs. It doesn’t appear that telcos are designed to deliver the promise of 5G.

At the end of the day, given the existing debt accumulated to consolidate spectrum for 5G, it’s also hard to see the traditional telco making the HUGE investment required in getting beyond consumer mobility to these higher value IoT or Enterprise experiences/services – recreating what already exists in companies like PacketFabric and our partners – private, cloud-centric NaaS for 5G. The good news is that our NaaS is agnostic and our reseller capabilities and core intellectual property enable telco incumbents, cloud-first startups and their value-add wholesalers alike. The partnership between telcos and NaaS companies is how the entire ecosystem participates.

The Next Gen Service Provider for 5G

5G really needs a programmable industrial network and that’s going to require a “next gen” Service Provider (ngSP) for alignment both in connectivity and agility.

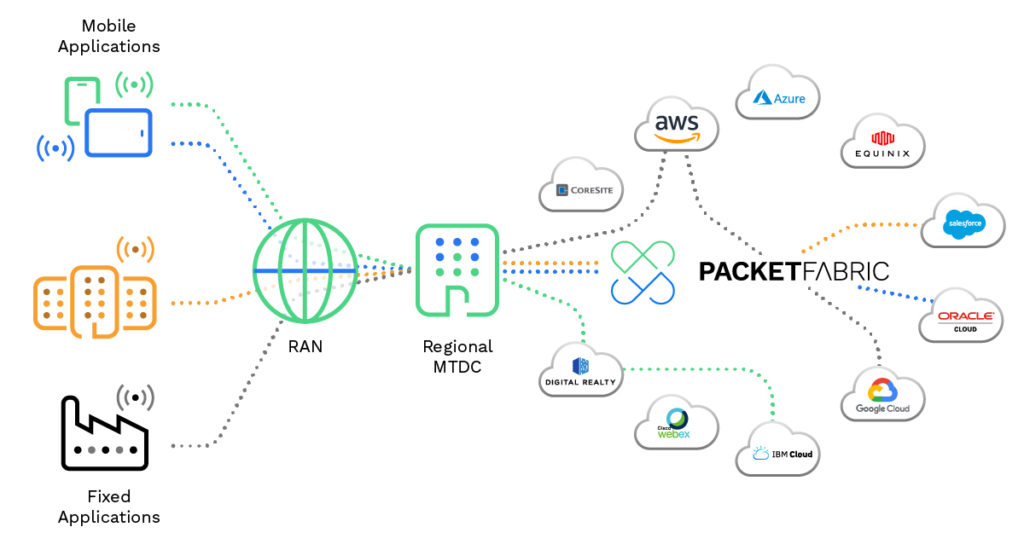

The service flows for 5G for Enterprise (and even some consumer MVNO opportunities) follow a now-familiar pattern for all modern cloud (or cloud-to-cloud) services:

- Subscriber data exits the lower-layer provider access network (mobile RAN) and goes to a cloud (or clouds) where the subscriber session is terminated and (potentially another cloud) where the real value-add security services are applied, then to a SaaS application cloud, then pulling data from a storage cloud, and then yet another cloud, on and on from one cloud to the next.

- The “meet points” aggregating the data to the cloud are often familiar regional public/private multi-tenant data centers (MTDCs) and peering points, where flows exit the public network onto private ones.

- The service requires a real yet, private backbone to stitch subscriber geographies, session termination cloud, security, storage, SaaS and application/backend cloud presences into a cohesive (and fault tolerant) operation.

This is where PacketFabric has a role in the 5G revolution. We’re really the ideal network for 5G service architectures. We are the only network that can provide industrial enterprise mission critical class, secure, high speed connectivity. PacketFabric is where the WAN becomes Cloud and Network becomes Code:

- On-demand provisioning

- Any-to-any connectivity

- Elastic consumption

- Portal and programmable API

- Flexible bandwidth deployment

- Engineered paths with strict SLAs

Big telcos may have the spectrum, but PacketFabric can deliver the 5G experience. PacketFabric can handle the rapidly changing demands of an enterprise’s digital transformation, the multi-cloud nature of IT/productivity services, and workflows. We provide the fastest and most agile network from your subscriber’s hand/device to the clouds. We’re perfect connectivity partners for 5G virtual operators, developing industrial IoT manufacturer spinups/spinouts, Enterprise P-LTE operators and managed service provider partners. We are what defines on-demand cloud core.

Footnotes

1 Markets and Markets, Mobile Experts

2 AT&T, Cellnext, KK, etc.